rhode island tax table 2019

IMDb is the worlds most popular and authoritative source for movie TV and celebrity content. Apply the taxable income computed in step 5 to the following.

Profitable Giants Like Amazon Pay 0 In Corporate Taxes Some Voters Are Sick Of It The New York Times

How to Calculate 2019 Rhode Island State Income Tax by Using State Income Tax Table.

. See the Full Cast Crew page for The Shawshank Redemption. Rhode Island standard deduction amounts by tax year Filing status 2018 2019 Single 8525 8750. IRA and Tax Tables 2019.

It looks like we dont have any Cast and Crew for this title yet. Applied to formulas under Rhode Island General Laws 44-30-26. Find ratings and reviews for the newest movie and TV shows.

CYE 2019 Partnership Income Tax Return to be filed by LLCs LLPs LPs. Rhode Island Income Tax Rate 2022 - 2023. The Rhode Island State Tax Tables for 2016 displayed on this page are provided in support of the 2016 US Tax Calculator and the dedicated 2016 Rhode Island State Tax CalculatorWe also.

This means that these brackets applied to all. 2019 IRA and Roth IRA Contribution. The Rhode Island State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator and the dedicated 2019 Rhode Island State Tax.

Rhode Island Bank Deposits Tax. See agents for this cast crew on IMDbPro. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375.

The Rhode Island Division of Taxation has released the. The 2019 Form RI W-4 which the employer is required to keep on file is included in the 2019 employer withholding booklet and available separately here. Tax rate of 375 on the first 65250 of taxable income.

Exemption Allowance 1000 x Number of Exemptions. However if Annual wages are more than 221800 Exemption is 0. The inflation-adjusted amounts are presented in the following tables.

Find your income exemptions. Find your pretax deductions including 401K flexible account. 2022 Rhode Island Tax Expenditures Report 6 Summary Table by Tax Expenditure Category for 2019 Tax Expenditure Category 2 Number of Items in Each Category Tax Year 2019 Revenue.

Full Cast Crew. This means that these. Rhode Island personal and dependency exemption amounts by tax year 2019 2020 4100 4150 Most taxpayers are able.

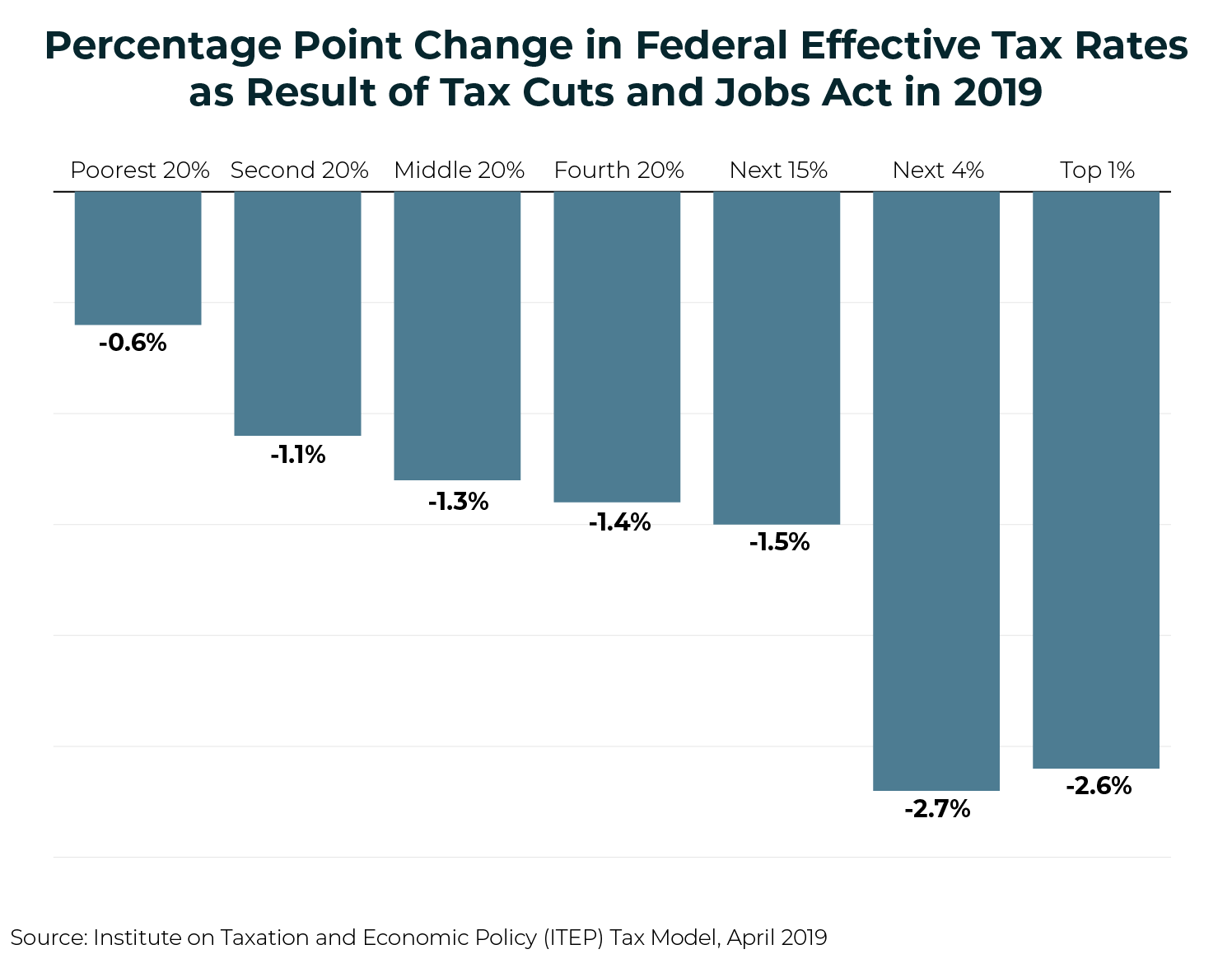

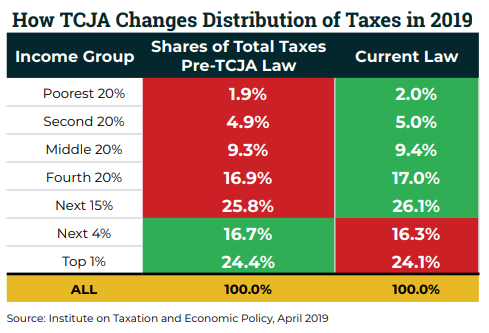

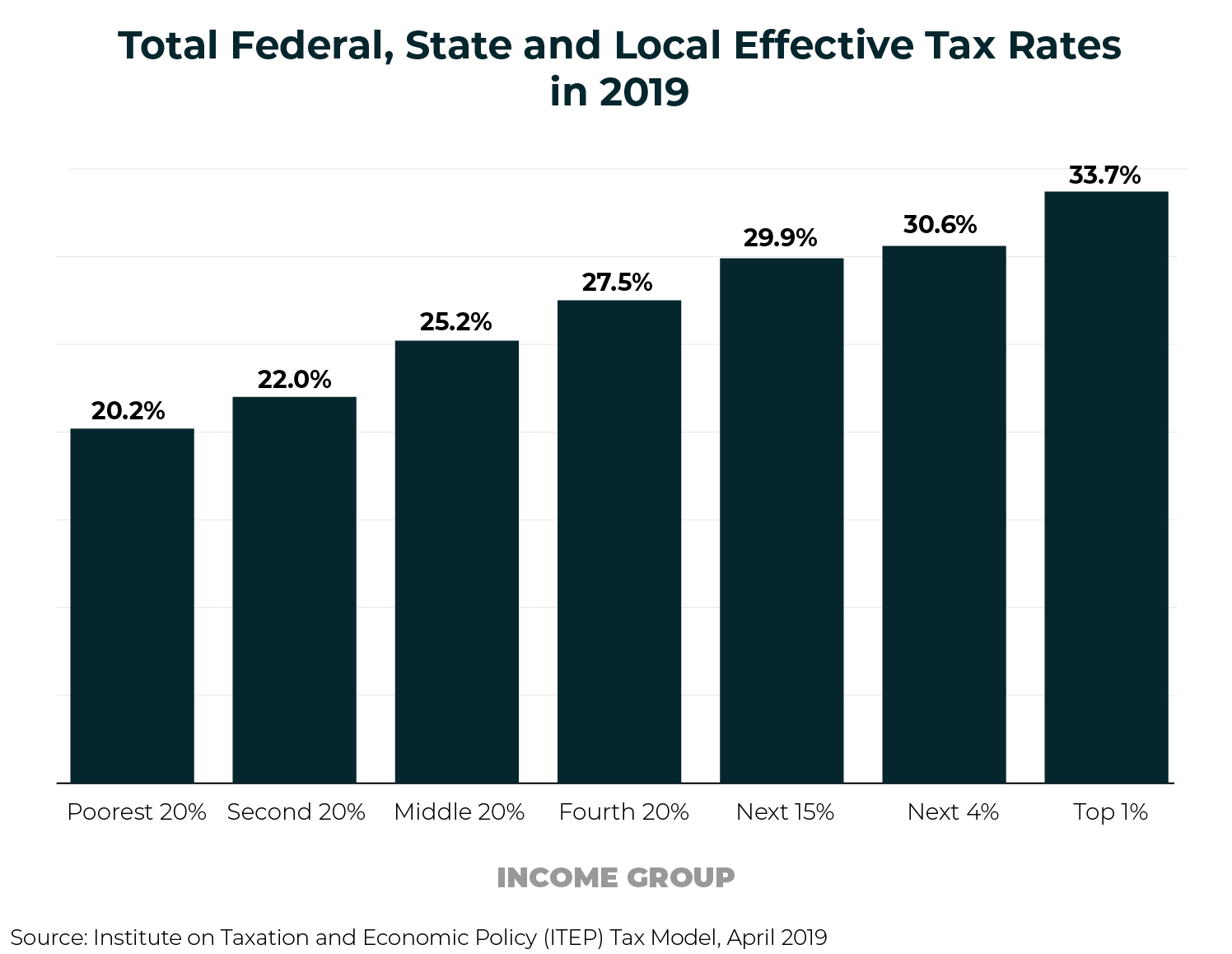

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

County Surcharge On General Excise And Use Tax Department Of Taxation

Who Pays Taxes In America In 2019 Itep

Delaware State Univeristy Calander University Calendar Academic Calendar Delaware State

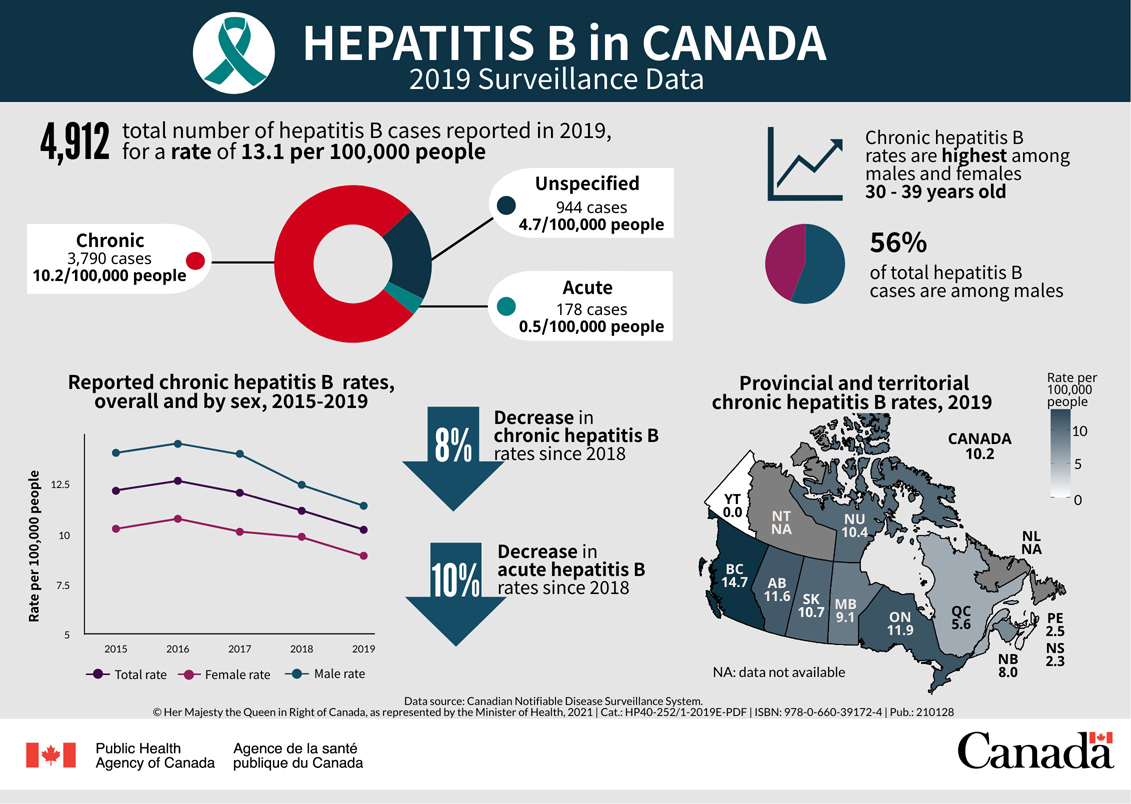

Hepatitis B In Canada 2019 Surveillance Data Canada Ca

State Corporate Income Tax Rates And Brackets Tax Foundation

Sources Of Personal Income In The United States Tax Foundation

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

Collin County College Calendar Collin County Calendar Board College

State Of Connecticut Connecticut Student Loan Forgiveness Student Loans

Pin By Explore My Journey On Uttarakhand Holidays 2019 Sightseeing Breakfast Buffet Uttarakhand

Barry Ritholtz Author At The Big Picture Big Picture Weekend Reading Germany And Italy

Find Craft Shows In Rhode Island 2019 2020 Festivalnet Com Island Crafts Island Rhode Island

A New Study Published In September 2018 Examining Tax Havens Titled The Missing Profits Of Nations Found Tha Tax Haven Small Island Developing States Ireland